In an increasingly interconnected global economy, staying informed about market trends is more crucial than ever. Whether you’re an investor, a trader, or simply someone interested in financial markets, having access to comprehensive and real-time market data can significantly impact your decision-making process. This is where Track All Markets comes into play. This powerful tool aims to provide users with a one-stop platform for monitoring and analyzing various financial markets. In this article, we will delve into what Track All Markets is, how it works, its features, pros and cons, alternatives, and finally, provide a conclusive verdict on its overall utility.

What is Track All Markets?

Track All Markets is a sophisticated market analysis platform designed to offer real-time data and insights across various financial markets. These markets include but are not limited to, stocks, bonds, commodities, foreign exchange, and cryptocurrencies. The platform aims to cater to a wide range of users, from individual investors and traders to financial professionals and institutions. By providing a centralized location for market data, Track All Markets helps users make informed decisions quickly and efficiently.

How Track All Markets Work

Track All Markets operates by aggregating data from multiple financial sources, including major exchanges, news outlets, and economic reports. The platform uses advanced algorithms and machine learning techniques to analyze this data and present it in a user-friendly interface. Here’s a breakdown of how it works:

- Data Aggregation: Track All Markets collects data from various financial sources, ensuring that users have access to the most up-to-date information.

- Data Processing: The platform processes this data using sophisticated algorithms that filter out noise and highlight significant trends and patterns.

- Data Presentation: The processed data is then presented to users through an intuitive dashboard, complete with charts, graphs, and other visual aids to facilitate easy understanding.

- Customization: Users can customize their dashboard to focus on specific markets, sectors, or instruments that are of particular interest to them.

- Alerts and Notifications: Track All Markets allows users to set up alerts and notifications for significant market movements, ensuring they never miss an important update.

Features of Track All Markets

Track All Markets boasts a wide array of features designed to enhance the user experience and provide comprehensive market insights. Here are some of the standout features:

Real-Time Data

Track All Markets provides real-time data across various financial markets. This feature ensures that users are always informed about the latest market movements, allowing them to make timely decisions.

Comprehensive Market Coverage

The platform covers a broad spectrum of markets, including stocks, bonds, commodities, foreign exchange, and cryptocurrencies. This extensive coverage makes it a one-stop solution for all your market tracking needs.

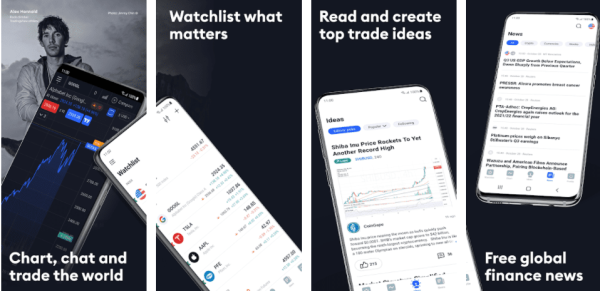

Customizable Dashboard

Users can customize their dashboard to focus on specific markets, sectors, or instruments. This feature allows for a personalized experience, ensuring that users can quickly access the information that matters most to them.

Advanced Analytics

Track All Markets offers advanced analytics tools that help users identify trends, patterns, and correlations across different markets. These tools include technical indicators, charting capabilities, and more.

Alerts and Notifications

Users can set up alerts and notifications for significant market movements or specific events. This feature ensures that they never miss an important update, regardless of their location or time zone.

Historical Data

The platform provides access to historical data, allowing users to analyze past market performance and make informed predictions about future trends.

News Integration

Track All Markets integrates news from major financial outlets, providing users with a comprehensive view of the factors influencing market movements.

User-Friendly Interface

The platform’s intuitive interface makes it easy for users to navigate and find the information they need. Whether you’re a novice or an experienced trader, you’ll find Track All Markets easy to use.

Pros of Track All Markets

| Pros | Description |

|---|---|

| Real-Time Data | Provides up-to-the-minute information across various financial markets, enabling timely decision-making. |

| Comprehensive Coverage | Covers a wide range of markets, including stocks, bonds, commodities, forex, and cryptocurrencies, making it a versatile tool. |

| Customizable Dashboard | Allows users to tailor their dashboard to focus on specific interests, enhancing the user experience. |

| Advanced Analytics | Offers sophisticated tools for trend analysis and pattern recognition, aiding in better market predictions. |

| Alerts and Notifications | Users can set alerts for significant market movements, ensuring they are always in the loop. |

| Historical Data Access | Provides access to historical market data, helping users make informed future predictions based on past performance. |

| News Integration | Integrates news from major financial outlets, giving users a comprehensive view of market influences. |

| User-Friendly Interface | The platform’s intuitive design makes it accessible to both novice and experienced traders. |

Cons of Track All Markets

| Cons | Description |

|---|---|

| Cost | The platform may be expensive for some users, especially individual investors or small businesses. |

| Complexity | The advanced features and tools may be overwhelming for beginners or those unfamiliar with market analysis. |

| Data Overload | With so much information available, users may experience information overload, making it difficult to focus on the most relevant data. |

| Internet Dependence | Requires a stable internet connection to access real-time data and updates, which can be a limitation in areas with poor connectivity. |

| Learning Curve | There may be a learning curve associated with using the platform effectively, especially for those new to market analysis tools. |

| Limited Mobile Functionality | The mobile version of the platform may lack some features available on the desktop version, affecting usability for on-the-go users. |

| Subscription Model | Ongoing subscription fees may add up over time, making it a recurring expense for users. |

| Platform Bugs | As with any software, there may be occasional bugs or glitches that could impact the user experience. |

Track All Markets Alternatives

| Alternative | Features | Pros | Cons |

|---|---|---|---|

| Bloomberg Terminal | Comprehensive financial data, advanced analytics, news integration, customizable dashboard. | Extensive market coverage, reliable data, industry-standard. | Expensive, complex for beginners, requires training. |

| Reuters Eikon | Real-time data, news integration, customizable dashboard, advanced analytics. | Reliable data, extensive market coverage, user-friendly interface. | Expensive, may be complex for beginners. |

| TradingView | Real-time data, customizable charts, social networking features, advanced analytics. | Affordable, user-friendly, community-driven insights. | Limited coverage compared to Bloomberg and Reuters, some advanced features require a premium subscription. |

| Yahoo Finance | Real-time data, news integration, basic analytics, portfolio tracking. | Free, user-friendly, good for beginners. | Limited advanced features, may not be comprehensive enough for professional traders. |

| MetaTrader 4/5 | Real-time data, customizable charts, algorithmic trading, advanced analytics. | Powerful trading tools, widely used in forex and commodities trading. | Steeper learning curve, primarily focused on forex and commodities. |

| Morningstar Direct | Investment research, portfolio management, real-time data, advanced analytics. | Comprehensive investment research, reliable data, good for portfolio management. | Expensive, may be too specialized for general market tracking. |

| Robinhood | Real-time data, commission-free trading, news integration, basic analytics. | Free trading, user-friendly interface, good for beginners. | Limited advanced features, focuses primarily on stocks and ETFs. |

Conclusion and Verdict on Track All Markets

Track All Markets emerges as a robust and comprehensive platform for market analysis and tracking. Its extensive coverage, real-time data, advanced analytics, and customizable dashboard make it a valuable tool for a wide range of users, from individual investors to financial professionals. However, the platform’s cost, complexity, and potential for information overload may pose challenges for some users. Despite these drawbacks, Track All Markets stands out for its ability to provide a centralized location for diverse market data, aiding users in making informed decisions.

In conclusion, Track All Markets is a highly effective tool for those serious about market tracking and analysis. While it may not be the most accessible option for beginners or those with budget constraints, its comprehensive features and capabilities make it a worthwhile investment for dedicated market participants.

FAQs Track All Markets

1. What markets does Track All Markets cover?

Track All Markets covers a wide range of financial markets, including stocks, bonds, commodities, foreign exchange, and cryptocurrencies.

2. Is Track All Markets suitable for beginners?

While Track All Markets offers a user-friendly interface, its advanced features and tools may be overwhelming for beginners. However, with time and practice, beginners can learn to navigate and utilize the platform effectively.

3. How much does Track All Markets cost?

The cost of Track All Markets can vary depending on the subscription plan chosen. It is advisable to check the official website for the most up-to-date pricing information.

4. Can I customize my dashboard on Track All Markets?

Yes, Track All Markets allows users to customize their dashboard to focus on specific markets, sectors, or instruments of interest.

5. Does Track All Markets provide alerts and notifications?

Yes, users can set up alerts and notifications for significant market movements or specific events, ensuring they never miss important updates.

6. Is historical data available on Track All Markets?

Yes, Track All Markets provides access to historical data, allowing users to analyze past market performance and make informed predictions about future trends.

7. What are the alternatives to Track All Markets?

Some alternatives to Track All Markets include Bloomberg Terminal, Reuters Eikon, TradingView, Yahoo Finance, MetaTrader 4/5, Morningstar Direct, and Robinhood.

8. Can I access Track All Markets on my mobile device?

Yes, Track All Markets offers a mobile version, but it may lack some features available on the desktop version.

9. Does Track All Markets integrate news from financial outlets?

Yes, Track All Markets integrates news from major financial outlets, providing users with a comprehensive view of the factors influencing market movements.

10. Is there a learning curve associated with Track All Markets?

Yes, there may be a learning curve, especially for those new to market analysis tools. However, the platform’s intuitive interface can help ease the learning process.